Commitments

A commitment is an agreement by a lender to grant a loan or loans for a specified amount of money at a future date. The holder of the commitment may pay a fee to reserve the funds, but is not required to pay interest on the money unless it is actually borrowed.

A commitment differs from a line of credit, in that each draw under the commitment may be a separate loan with differing interest rates and different repayment terms. On a line of credit loan, the interest rates and repayment terms are set in advance for the entire credit line.

The diagram below shows how commitments fit into the structure and hierarchy of NLS:

In the example shown above, Johnson Company has three separate loans which amount to a total of $800,000. These loans are under the commitment for $1,000,000, so the Johnson Company could still take out another loan for $200,000 if the company wanted to do so any time within the remaining term of the commitment.

Adding a Commitment

A commitment is added directly to a contact, so in order to add a commitment, begin by querying the contact for the customer who is receiving the commitment.

Click  under

under  in the ribbon bar and select Add Commitment.

in the ribbon bar and select Add Commitment.

The commitment entry screen is identical to the loan entry screen (specifically for Line of Credit type loans) but with certain fields and functions missing (such as the loan amount). The commitment amount is entered in the credit line fields.

Adding a Loan to a Commitment

To add a loan under a commitment, first query the commitment. You may do this from the Loan Query screen, or by querying the contact then expanding the tree to view the loans and commitments under that contact. Click on the desired commitment.

Click  under

under  in the ribbon bar and select Add Loan Under Commitment.

in the ribbon bar and select Add Loan Under Commitment.

The Loan Entry Screen that comes up will already have the loan properly linked up under the commitment. The remaining parameters of the loan should be added as usual.

Detaching a Loan from a Commitment

To detach a loan from a commitment, query the commitment and expand the tree under the commitment. Click on the loan attached to the commitment to highlight it. Then click  under

under  in the ribbon bar and select Detach Loan From Commitment.

in the ribbon bar and select Detach Loan From Commitment.

Re-attaching a Loan to a Commitment

To re-attach a loan to a commitment, query the loan and click LOAN >  Loan Setup in the ribbon bar. Click

Loan Setup in the ribbon bar. Click  next to the Master Note field and search for the commitment to which to attach the loan.

next to the Master Note field and search for the commitment to which to attach the loan.

Viewing Commitment Detail

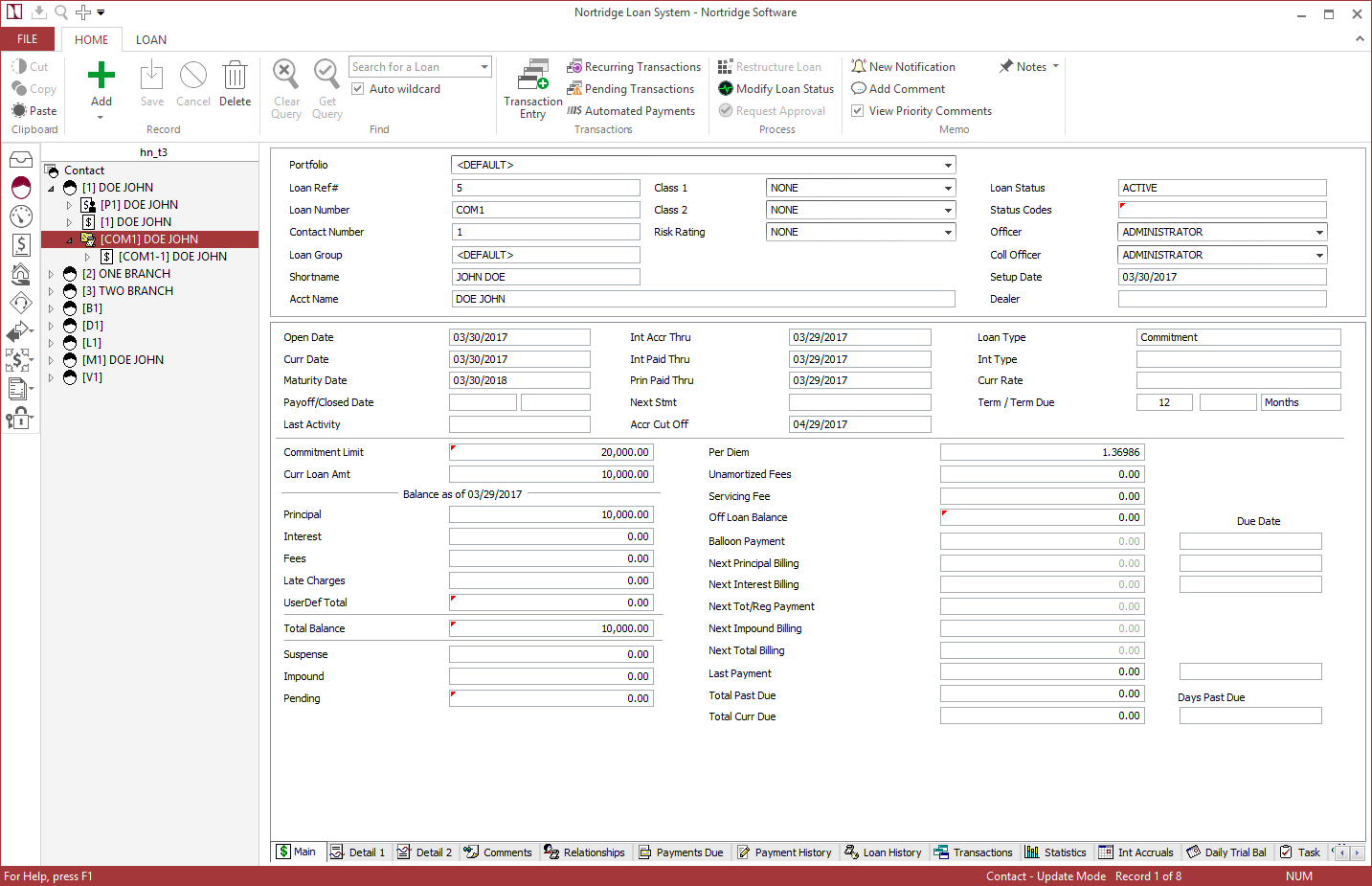

Once a commitment has been added to a contact, and a loan has been added to the commitment, the tree for this contact/commitment/loan combination will look like the example shown below.

If you view the commitment itself (just as you would view a loan), it will look like the example shown above.

The commitment limit is the amount that was defined when the commitment was created.

The rest of the balances on the commitment are the sums of the appropriate balances on all of the loans within that commitment.

The grayed out fields (interest rate, next payments due, regular payment, and days past due) do not apply to a commitment on its own, but will exist on the various loans that are present under the commitment.

Adding Automated Payments to Commitments

Automated payments may be added to a commitment loan.

Note

To draft billings for all loans under a commitment, set automated payments at the commitment loan level. Do not set automated payments at both the loan level and at the commitment level. Doing so will result in duplicate automated payments being drafted.When loans under a commitment have different due dates, they will be processed as separate transactions.

Credit Bureau for Commitments

When a credit bureau is set at a commitment level, NLS will consolidate all loans under the commitment and report to the credit bureau as one loan.

All credit bureau overrides are set at the commitment level. Any status code set under the commitment will be ignored.

Note

Once a credit bureau is set at a commitment level, the credit bureau cannot be set on loans under the commitment.

Commitment Distribution Order

Commitment distribution order may be configured in Setup > Loan Setup > Defaults.