Create an ACH/AFT

AFT support available in NLS 5.5.1 and later

NSL 4.10.7 and later

To create a new ACH Batch, go to the Processing slider on the shortcut bar or select View > Processing > Transactions and click Create ACH  on the toolbar.

on the toolbar.

To create a new ACH/AFT Batch, click Processing  on the shortcut bar and select Transaction

on the shortcut bar and select Transaction  . Click Create ACH

. Click Create ACH  in the ribbon bar to open the Create New ACH Batch dialog.

in the ribbon bar to open the Create New ACH Batch dialog.

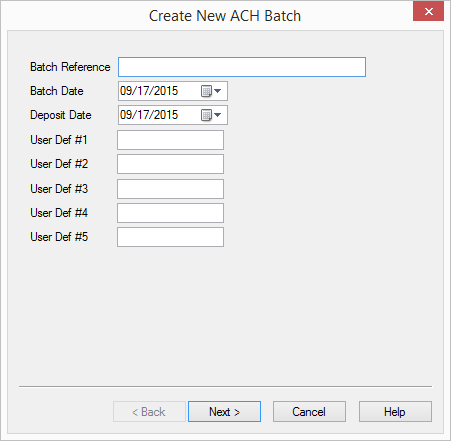

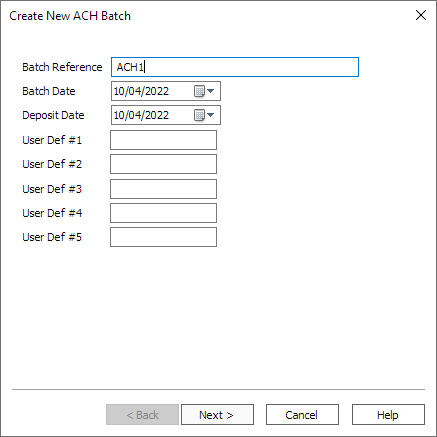

Enter a Batch Reference number for the ACH/AFT, a Batch Date, and a Deposit Date. NLS allows up to five user-defined fields to be configured for use with the ACH. Depending upon what information your company is tracking in these user-defined fields, you may need to fill in these fields as well.

When all fields are filled in, click Next >.

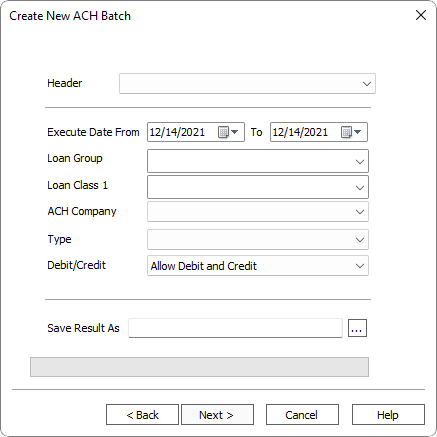

NLS 5.5.1 and later

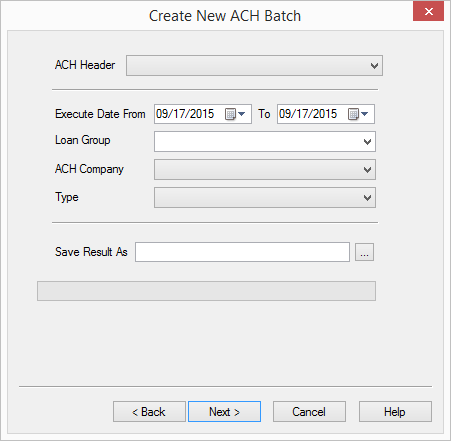

Select a Header Type if NLS is configured for both ACH and AFT support.Select a Header from those that were configured in the global automated payments setup. The Execute Date From and To values define the date range for the ACH/AFT. All loans that have ACH/AFT draws scheduled during this range of dates will be included.

Example

If the current date is January 19, 2018, set Execute Date From 1/20/2018 To 1/26/2018 to process loans for the following week.Selecting a Loan Group or Loan Class 1 limits the ACH/AFT to loans in that group or class. Filtering can be used to process ACH/AFT in smaller batches. If no loan group or loan class 1 is selected, the ACH/AFT will include all loans for which an ACH/AFT is scheduled in the selected date range. The ACH/AFT batch may also be filtered by ACH/AFT company.

Click

next to Save Result As to select the location to where you want the generated ACH/AFT file to be saved and its file name.

next to Save Result As to select the location to where you want the generated ACH/AFT file to be saved and its file name.

Note

The Save Result As field will not be available if the Force ACH/AFT to use this filename & location advance option was configured for the selected ACH/AFT header.When all fields have been filled in, click Next >.

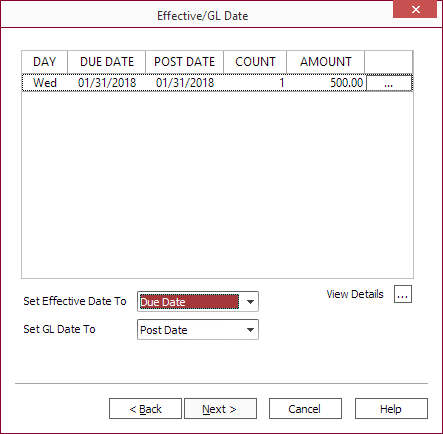

An alert dialog will appear if there are no ACH/AFT transactions within the given date range. If there are ACH/AFT transactions to process, a window will list the ACH/AFT transactions to review before continuing with the process.

Click the ellipsis button on each of the listed item to change the post date for that ACH/AFT.

Choose whether to use the Due Date, Post Date, or Lesser of Due/Post Date from the Set Effective Date To and Set GL Date To drop down list.

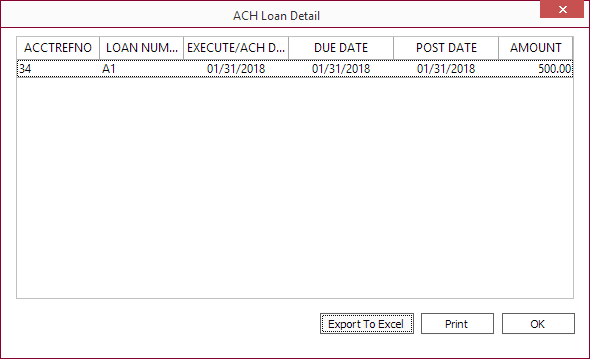

Click View Details

to see a detailed view of the ACH/AFT with the option to print or export the data to an Excel file.

to see a detailed view of the ACH/AFT with the option to print or export the data to an Excel file.

Note

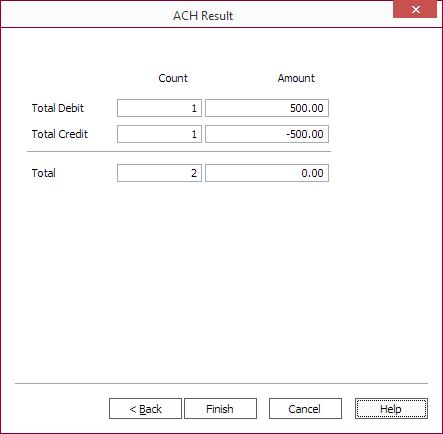

If you notice any issues after reviewing the details, click Cancel and make any necessary corrections. Once the ACH/AFT is processed, the ACH/AFT cannot be reversed. The only recourse is to wait for the transaction date to pass then reverse the transaction.Click Next > to see a summary of the transactions to be processed.

Click Finish to process the ACH/AFT and save it to the specified file location. All transactions that falls within the specified dates will be included in the resulting output.

On any loans for which an ACH/AFT transaction was created, that transaction will be entered as a pending transaction. It will be processed automatically during the nightly accrual processing run when the pending transaction’s effective date is reached. Pending payments effectively post on the morning of their posting date, so they will occur during the end of day processing for the previous night. This way, if accruals are up to date, on any day where you observe a loan that had a pending transaction scheduled for the current date, that transaction will have posted unless it was created the same day by a back-dated ACH/AFT process.