Deferments

Available in NLS 5.4 and later

Simple interest deferment available in NLS 5.6 and later

Billings on rule of 78, fixed amortization, and simple interest loans can be deferred so that the accrual for that period becomes 0 (zero) with accruals resuming on the next non-deferred period.

NLS 5.14 and later

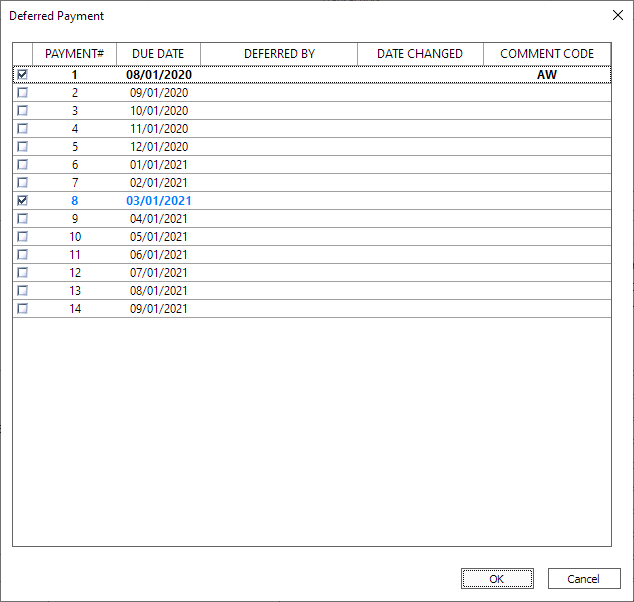

Loans can be set to continue accruing interest during a deferred period by setting the deferment option in a loan’s payment determination configuration.To defer billings, query the loan and  Deferred Payment

Deferred Payment

Select the checkbox for the payment number to defer.

NLS 5.20 and later

Click on the comment code column to select a comment code for use in Metro 2 reporting for the deferment.Available comment codes

| AW | Affected by natural disaster |

| BO | Foreclosure proceedings started |

| CN | Loan Modified under a Federal Government Plan |

| CO | Loan Modified |

| B | Account payments managed by Credit Counseling Service |

| AC | Paying under a partial payment agreement |

| AI | Recalled to active military duty |

| BT | Principal deferred / Interest payment only |

| CP | Account in Forbearance |

Click OK to commit the changes.

NLS 5.18 and later

Deferments may be undone on simple interest loans only. Undoing a deferment is not available for Fixed Amortization and Rule of 78 loans.Interest Accrual and GL

Rule of 78

- Main interest will be 0 and GL reporting will not occur.

- Actuarial interest continues and GL reporting continues. The same GL is used for normal and deferred periods.

Fixed Amortization

- Main interest will be 0 and GL reporting will not occur.

Simple Interest

- Interest will be 0 and GL reporting will not occur.

- If Continue to Accrue Interest during Deferred Period option is selected, interest continues to accrue and GL reporting continues. The same GL is used for normal and deferred periods.

Fixed Amortization Loan Rebate Rule

For fixed amortization loans, the rebate rule can be configured to include or exclude the deferred payments on payoff.

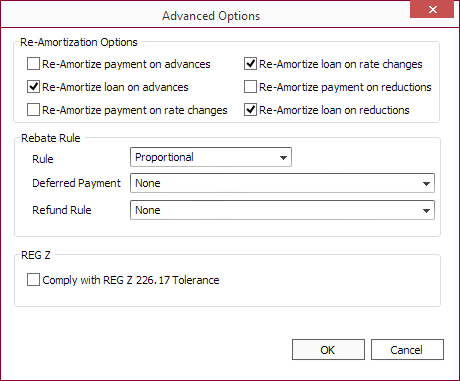

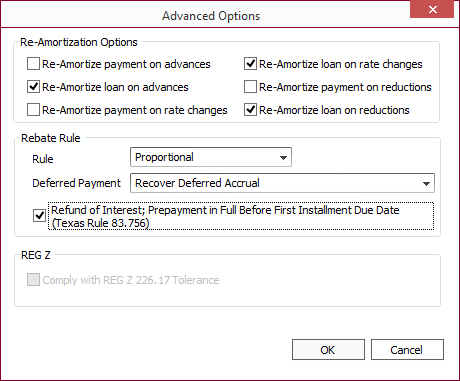

Go to the advanced options of loan account payment determination dialog (Loan Setup > Payment Period... > Advanced), under Rebate Rule, select the appropriate Deferred Payment option from the drop down list.

| None | Earned interest is based on the original amortization schedule regardless of any payment deferrals. |

| Recover Deferred Accrual | Earned interest from deferred payments are recovered whether the payoff is made before or after the loan's maturity date. |

| Recover Deferred Accrual (Disable After Orig Maturity) | Earned interest from deferred payments are recovered only when a payoff occurs before the loan's maturity date. |