Participant Query

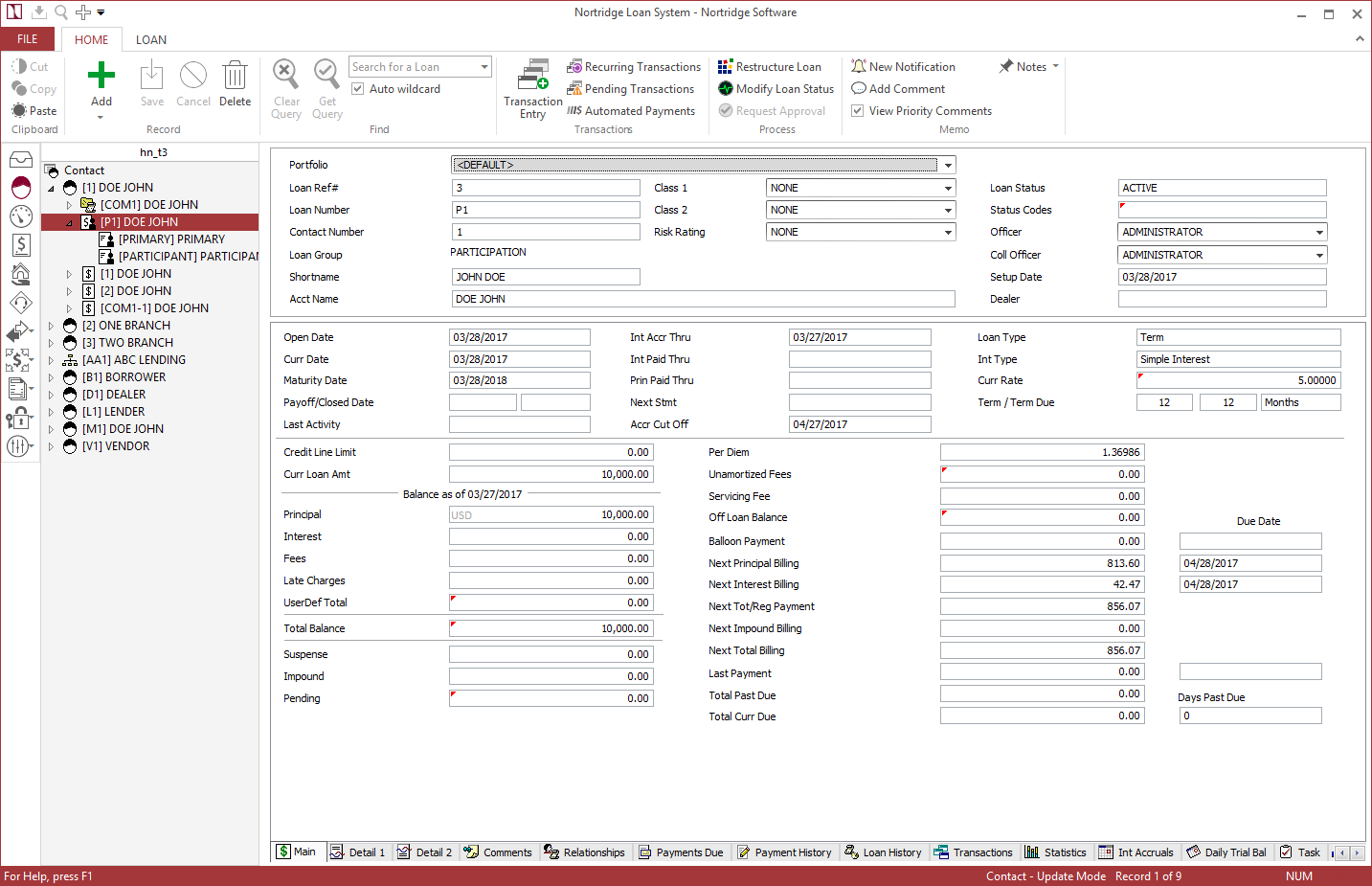

Participation loans are queried normally, just like other types of loans. Click +  next to the loan on the search tree to expand the loan to show its sub-loans.

next to the loan on the search tree to expand the loan to show its sub-loans.

Clicking on one of the individual participant sub-loans will allow you to view the informational tabs for just that sub-loan.

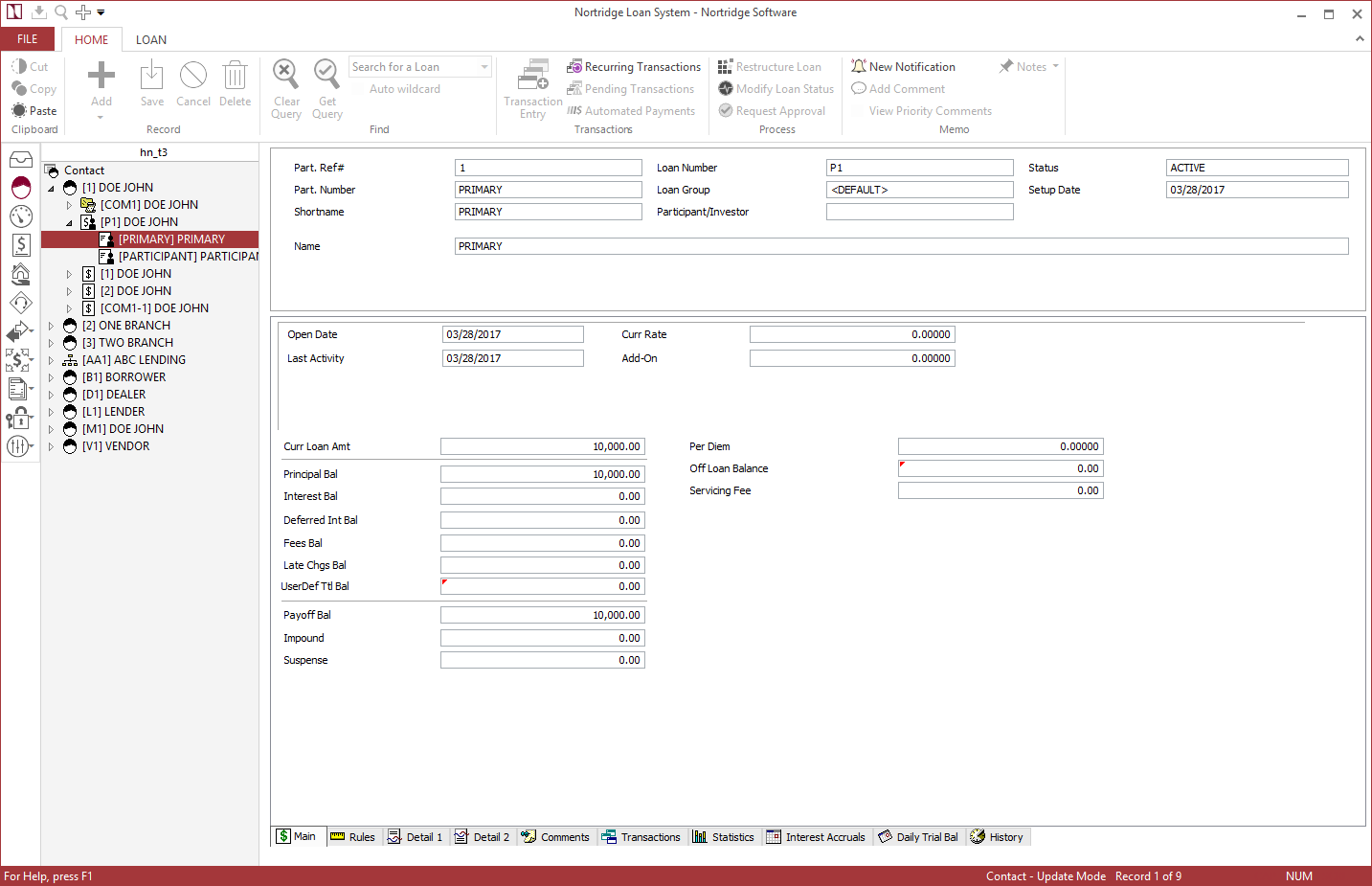

Main

Main

The Main tab of the query screen for a participant contains the same data as the Main tab for a loan, but many of the parameters (such as data on upcoming payments) are not displayed as they do not apply to a sub-loan.

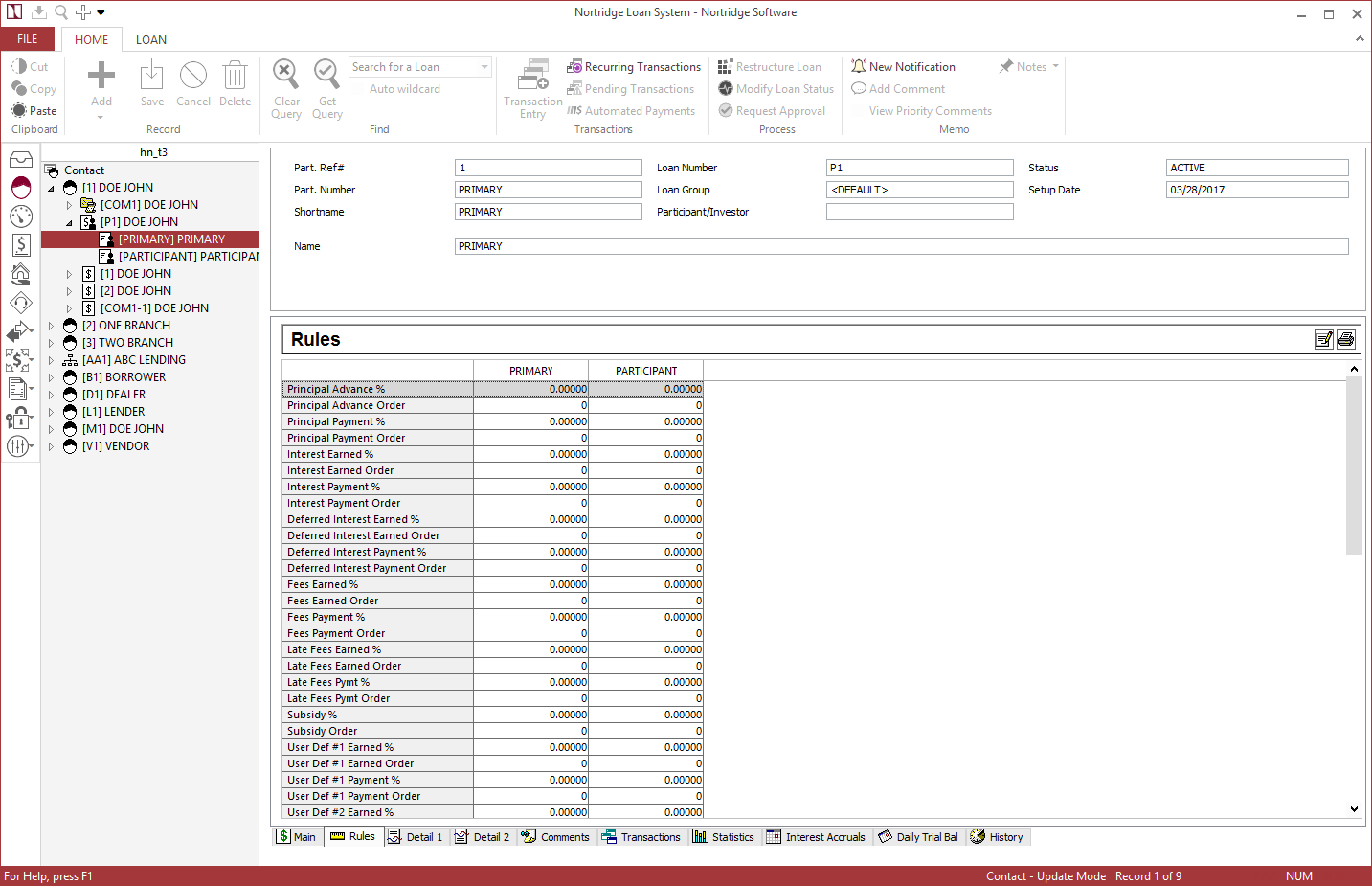

Rules

Rules

Clicking the Rules tab on any participant allows access to the rules for all of the participants on the loan. For each item in the rules, you may set either a percentage or an order hierarchy.

Example A

If the Principal Advance % rule was set to 80% on participant #1 and 20% on participant #2, and the loan had a principal advance of $1,000,000, the advance would be automatically broken down as $800,000 on participant #1 and $200,000 on participant #2. If order hierarchy were used instead, then the appropriate transaction would go entirely to the first designated participant until that transaction could no longer be applied.Example B

If the Interest Payment Order rule was set to participant #1 first and participant #2 second, and if participant #1 had an interest balance of $137.72 and participant #2 had an interest balance of $496.34, a payment for $200 would be applied to cover the entire $137.72 on participant #1 and the remaining $62.28 would go to reduce the balance of participant #2 to $434.06.

Comments

Comments

The Comments tab, when accessed from a participant, allows access to the loan commenting system and those comments that have been added to that particular participant sub-loan.

The functions of the buttons are:

Add Add |

This button allows you to log a new comment. The comment will be automatically stamped with the date and time, and your User ID number. |

Delete Delete |

This button will remove the highlighted comment if you have the privilege to delete comments. |

Modify Modify |

This button will allow you to edit an existing comment if you have the privilege to modify comments. |

Print Print |

This button will print out all of the existing comments on the currently selected contact. |

Search Search |

This button allows you to search the database comments for key words. The search may include just the currently selected contact, or may search the entire table. |

Show Categories Show Categories |

This button toggles between show and hide category mode. Using comment categories, the comments may be stored in separate “file folders.” |

Transactions

Transactions

All transactions for a particular participant sub-loan are listed in the Transaction History of that participant. The date and time of the actual moment of transaction entry are recorded along with the user ID. The effective date is the date entered by the user at the time of transaction entry.

When a transaction is reversed, it is not taken off of Transaction History, but a reversing transaction is added. The Transaction History, therefore, will show a complete history of every event that has happened on the sub-loan except for interest accruals, rate changes, and modifications to the loan setup.

The functions of the buttons are:

Hide Reversed Transactions Hide Reversed Transactions |

This button will toggle the display to show or hide reversed transactions. |

Print Print |

This button will print out the full list of the transaction history. |

Comments Comments |

Clicking this button brings up a comments window which will allow you to add comments that are linked directly to individual transactions. |

Statistics

Statistics

Complete statistical data for each participant sub-loan is available through the Statistics tab.

The statistics are shown for the participant sub-loan Life to Date, for each calendar year of the loan’s existence, and for each month of the loan’s existence.

| Principal Advanced | The sum of all Principal Advance Transactions made during the statistical period. |

| Principal Paid | The sum of all principal payments made during the statistical period. |

| Interest Earned | The sum of all interest accruals and interest adjustments during the statistical period. As interest adjustments may be positive or negative, any negative interest adjustments during the statistical period will reduce the total Interest Earned. |

| Interest Paid | The sum of all Interest Payments made during the statistical period. |

| Late Charges Earned | The sum of all late charges assessed during the statistical period. |

| Late Charges Paid | The sum of all late fee payments made during the statistical period. |

| Misc Fees Earned | The sum of all fees (other than late fees) assessed during the statistical period. |

| Misc Fees Paid | The sum of all fee payments (other than late fees) made during the statistical period. |

| Escrow Interest Earned | This statistic is not currently in use. |

| Escrow Interest Paid | This statistic is not currently in use. |

| Average Balance | The sum of all daily balances during the statistical period, divided by the number of days in the period. |

| High Balance | The greatest single daily balance for the loan in the statistical period. |

| Low Balance | The lowest single daily balance for the loan in the statistical period. |

| Past Due 30/60/90/120+ | A counter of the number of distinct billings that have gone one, two, three, or four or more months past due. When a payment becomes 60 days past due, its counter is taken off 30. The sum of these counts should not exceed the total number of payments that have ever been past due. |

| Past Due 10 Days | A count of all distinct billings that have gone 10 or more days past due. |

| NSF Payment | This statistic is not currently in use. |

| User Def # 1–25 | These statistics are defined by the system administrator, and may be updated by user-defined transactions. |

Interest Accruals

Interest Accruals

The Interest Accruals tab provides access to all of the daily accruals that have been earned on the participant sub-loan. The accruals are aggregated into monthly totals, but the daily accruals may be accessed for any month by clicking on that month.

The functions of the buttons are:

Show/Hide Corrections Show/Hide Corrections |

Toggles the display of daily accruals that have been superseded by correcting entries back into the list. |

Print Print |

This button will print out the full list of the accrual history, either the monthly aggregates or the daily accruals for the selected month. |

Daily Trial Balance

Daily Trial Balance

The Daily Trial Balance tab provides access to the Actual Trial Balance Entries and the Effective Trial Balance Entries on the participant sub-loan.

The functions of the buttons are:

Print Print |

This button will print out the full list of the trial balance history for the selected month. |

History

History

The Field History tab provides access to the history of all modifications that have been made to the participation and the participant sub-loan setup.

The functions of the buttons are:

Print Print |

This button will print out the full list of the modification history. |

Modify Modify |

This button allows you to add or modify notes about the currently selected Loan Setup Modification History item. |

Filter Query Filter Query |

By default, the field history shows the complete list of modifications for the currently selected loan. By clicking this button, you can run a search on all of the modification history in the database. |

Refresh Record Refresh Record |

Clicking this button will reload the modification history for the current loan. This will allow you to view any modifications that you have just made to the loan, or any modifications that have been made to this loan by other users since the last query was run. |