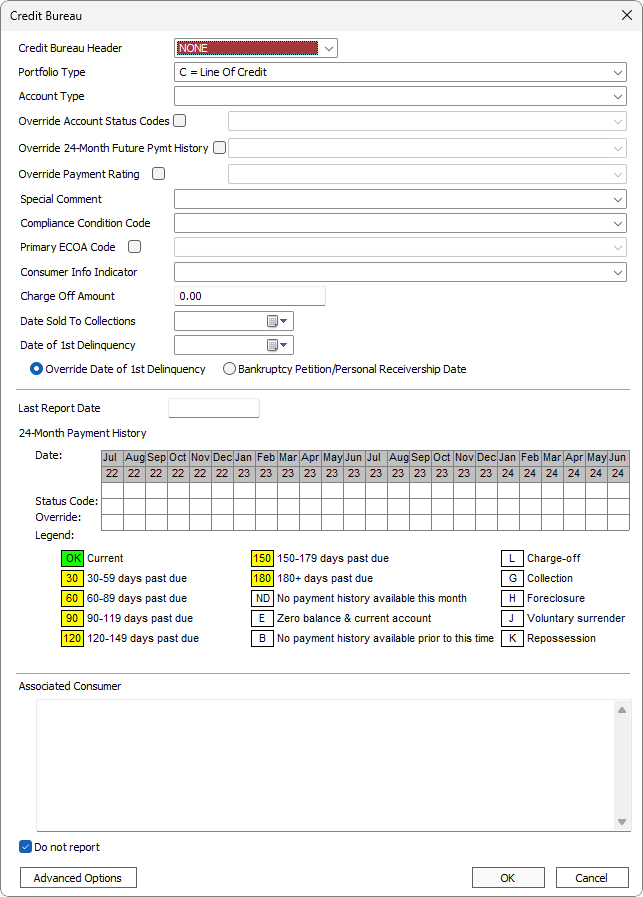

View Credit Bureau Report on Individual Loan

Select

Loan >

Credit Bureau Report

Credit Bureau Report >

Credit Bureau Setup.

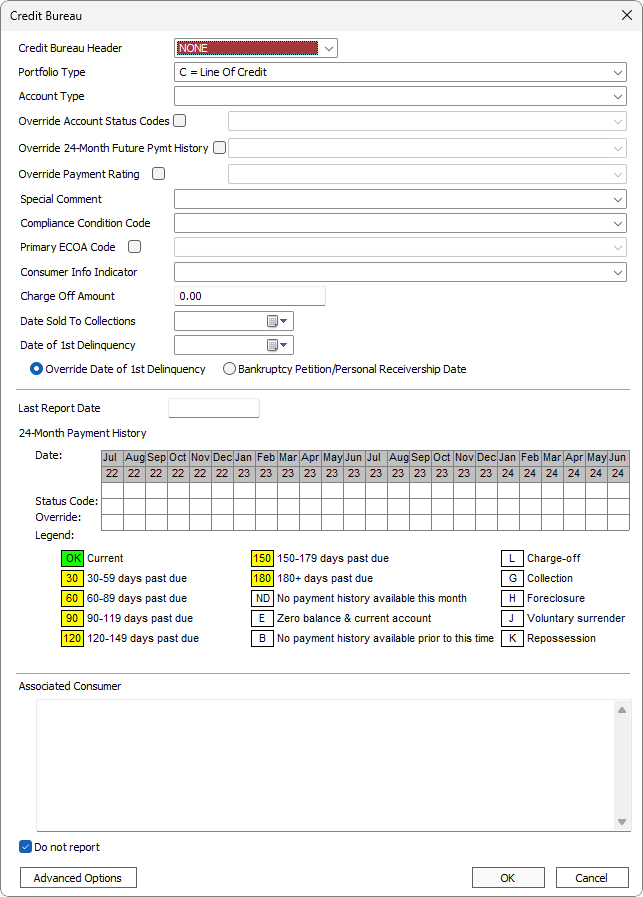

| Credit Bureau Header

|

The header that was configured in loan setup and contains your company’s credit bureau account information.

|

| Portfolio Type

|

Line of Credit, Installment, Mortgage, Open Account, or Revolving

|

| Account Type

|

Identifies the account classification as recognized by the credit bureaus. Some examples include: Agricultural, Attorney Fees, and Auto. |

| Override Account Status Codes

|

If needed the account status code can be overridden by selecting this option and choosing the appropriate item from the drop down

list. |

| Override 24-Month Future Pymt History |

If needed the 24 month future payment history data can be overridden by selecting this option and choosing the appropriate item from the drop down list. |

| Override Payment Rating |

If needed the payment rating can be overridden by selecting this option and choosing the appropriate item from the drop down list. |

| Special Comment

|

Special Comment may be used in conjunction with the Account Status to further define the account.

|

| Compliance Condition Code

|

Allows the reporting of a condition that is required for legal compliance (e.g., according to the Fair Credit Reporting Act (FCRA) or Fair Credit Billing Act (FCBA)).

|

| Primary ECOA Code

|

Defines the relationship of the primary consumer to the account and designates the account as joint, individual, etc., in compliance with the Equal Credit Opportunity ACT.

|

| Consumer Info Indicator

|

Contains a value that indicates a special condition of the account that applies to the primary consumer. This special condition may be that a bankruptcy was filed, discharged, dismissed, or withdrawn; a debt was reaffirmed; or the consumer cannot be located or is now located. The indicator should be reported one time and will be deleted only when the condition no longer exists.

|

| Charge Off Amount

|

This field will contain any amount that was charged off and was intended to be reported to the credit bureau.

|

Date Sold to Collections 5.41+ |

This date will override the Date Opened date. Terms Frequency will also be set to empty. |

| Date of 1st Delinquency |

Date of 1st delinquency override date. |

| Override Date of 1st Delinquency |

The date of 1st delinquency (DOFD) may be overridden by specifying a new date. |

| Bankruptcy Petition / Personal Receivership Date |

Reports the DOFD date only if AccountStatus=5, 11, 13 and CII=A-H, Z, 1A, V-Y. The actual DOFD is used when DPD>=30. |

| Last Report Date

|

This field will contain the date the report was last run.

|

| 24-Month Payment History |

Status Code row will indicate any override generated by a status code. 5.28+

Override row indicates manual overrides. Click on the cell to cycle through the override types.5.21+

Override row indicates manual and status code overrides.5.20-

|

| Co-Borrower |

ECOA Code and Consumer Info Indicator options for the co-borrower will appear for borrowers of COUPLE entity. |

| Associated Consumer |

Displays the contact information and ECOA code of the primary contact’s contact-loan relationship associated with the loan. |

| Do not report |

Loans with this option selected are not included in credit bureau reports. |

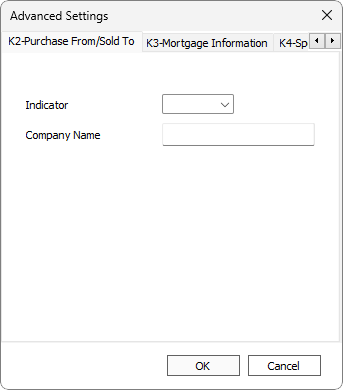

Advanced Options

NLS 5.11 and later

Click Advanced Options to configure K2, K3, and K4 segment information.

K2 SegmentK3 SegmentK4 Segment

K2 - Purchase From / Sold To

| Indicator |

1 = Purchased From Name

2 = Sold To Name

9 = Remove Previously Reported K2 Segment Information |

| Company Name |

This field is left blank if indicator is 9. |

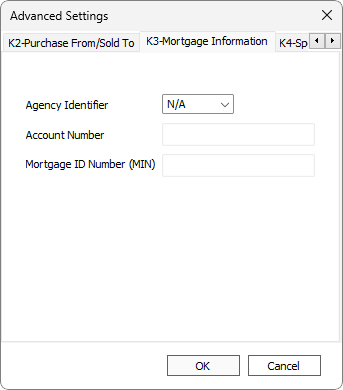

K3 - Mortgage Information

NLS 5.21 and later

| Agency Identifier |

Select N/A to not report K3. |

| Account Number |

Valid only if Agency Identifier is 01 or 02. Maximum of 18 alphanumeric characters. |

| Mortgage ID Number (MIN) |

Valid only if Agency Identifier is 00. Maximum of 18 alphanumeric characters. |

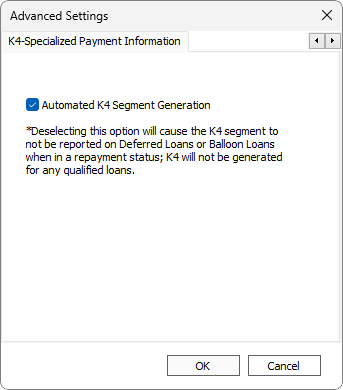

K4 - Specialized Payment Information

NLS 5.21.4 and later

If the Automated K4 Segment Generation option is selected, K4 is added to the report automatically if there is a balloon payment or a deferral in effect at the time of the reporting.

NLS 5.21 to 5.21.3

K4 is added to the report automatically if there is a balloon payment or a deferral in effect at the time of the reporting.

Note

L1 segment is added to the report automatically if the loan number has been modified since its last credit bureau report.

Once the monthly credit bureau processing has been completed, the 24 month history is populated with codes indicating the status of the loan at the end of each calendar month. Any of these can be overridden by clicking in the override field directly under the entry to be changed. After entering overrides, you may regenerate the Metro 2 file for submission to the credit bureaus, and the override history will continue to be the history reported each period until it is removed.

A modification comment may be entered for each override.

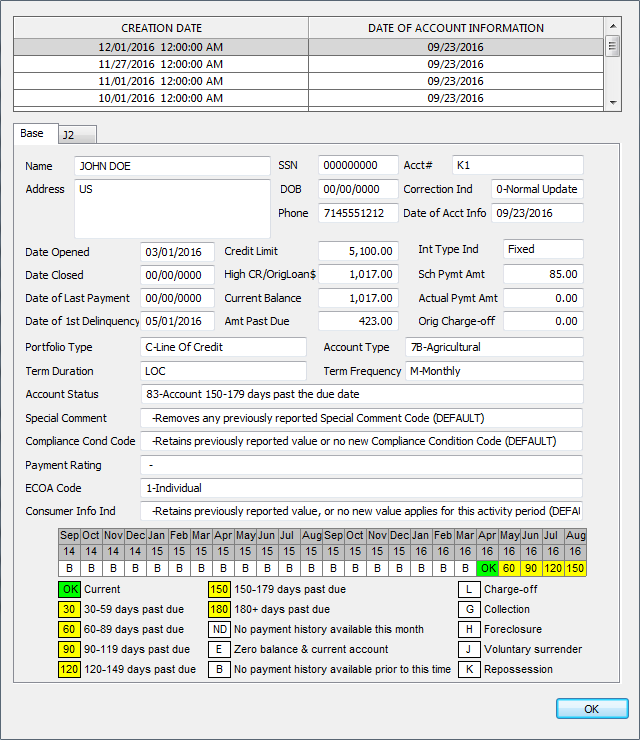

View Credit Bureau History

To view the credit bureau history on an individual loan, select Loan >  Credit Bureau Report > Credit Bureau History.

Credit Bureau Report > Credit Bureau History.

NLS 5.16 and later

To mask the data in the SSN and DOB fields from view for specific users, set the

Mask TIN and

Mask DOB security privilege in

Loan >

Credit Bureau >

Credit Bureau History.

Credit Bureau Report > Credit Bureau Setup.

Credit Bureau Report > Credit Bureau Setup.