Loan Group

For general ledger reporting purposes, the loans in your portfolio are organized into loan groups. All transactions for a loan belonging to a specific loan group are posted to a general ledger account that is defined in that loan group. If different groups of loans in your portfolio are posted to different loan asset accounts, they must be in separate loan groups.

The use of loan groups within the loan system increases the flexibility of the system by allowing the same transaction codes to be used for loans that post to different accounts. The transaction codes do not define specific accounts for their credits and debits. Instead the transaction codes specify a general category of GL account. These categories are assigned to specific GL accounts in the loan group.

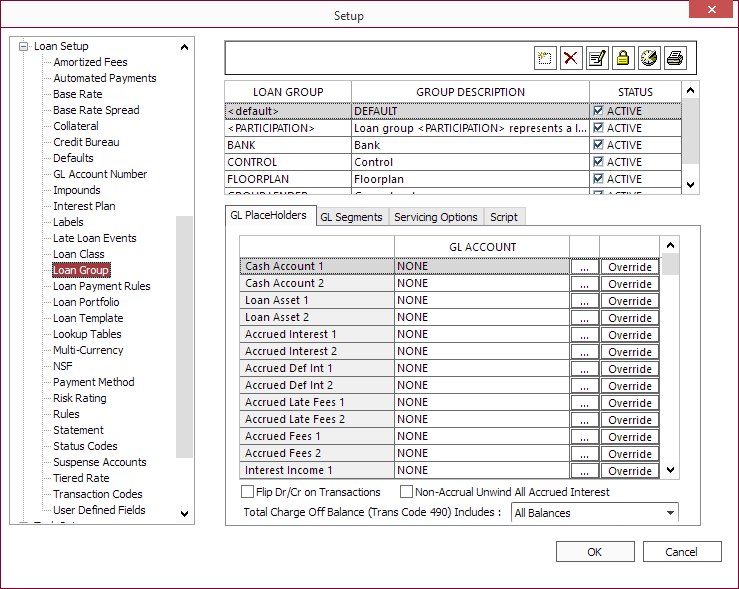

Loan groups are configured in Setup > Loan Setup > Loan Group.

The upper half of the Loan Group screen lists all of the currently configured loan groups. The lower half contains tabs that show the configuration of the general ledger accounts and participation information for the currently selected loan group.

Buttons

Add Add |

This button allows you to add a new loan group. Enter the Loan Group Code and description in the dialog box. To copy the settings from an existing loan group, select Copy settings from and select the loan group from which to copy the settings in the drop down list.5.26+ |

Delete Delete |

Clicking this button will remove the currently selected loan group only if there are no loans or transactions on the system which are tied to this loan group. This means that once a loan group is entered, added to a loan, and transactions are run on that loan, the loan group can never be deleted until all loans on that group or all loans that have ever had any transactions while they were a member of that group, are totally purged from the loan system. |

Modify Modify |

This button allows the modification of the loan group’s description and status. The actual GL account numbers assigned to the group are modified on their appropriate tabs. |

Trustee Trustee |

The Trustee feature allows you to set up a group of loans that can only be accessed by certain “Trustee” loan officers. To set the trustee access for a loan group, select that loan group and click the trustee button.

By default, the trustee access for a loan group is set to Everyone. If any user or user group is added to the list of trustees for this loan group, that list of trustees will supersede the setting: Everyone, and all users who are not then specifically included on the trustee list, or who are not members of groups that are included on the trustee list, will be locked out of all loans in this loan group. |

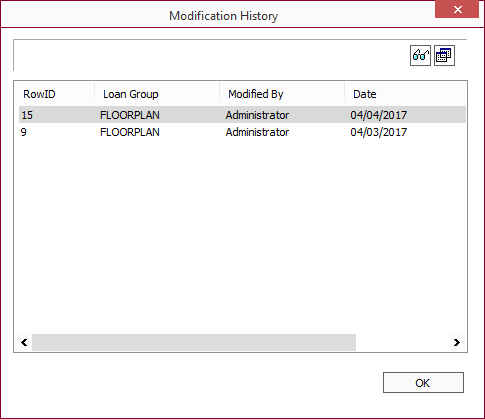

Modification History Modification History |

Shows a list of the changes that have been made to the Loan Group setup.

This list shows who has made modifications to the Loan Group and when.  |

Print Print |

Produces a printout of the complete list of loan groups. This printout does not include any of the detail on GL account configuration for any of those groups. |

GL PlaceHolders Tab

This tab lists the configuration of general ledger accounts for the currently selected Loan Group.

| Cash Account 1 | An asset account. This represents cash on hand or cash held in accounts for the purpose of lending. When principal is advanced, the amount is credited to this account. All cash payments are debited to this account. |

| Cash Account 2 | An alternate cash asset account for use with user-defined transaction codes. |

| Loan Asset 1 | This account contains the sum of the principal outstanding for all loans in the loan groups for which this asset account is used. When any principal payment is posted, the amount of the payment is credited to this account. |

| Loan Asset 2 | An alternate loan asset account for use with user-defined transaction codes. |

| Accrued Interest 1 | This is an asset account (receivable). It keeps track of the amount of interest owed by borrowers to the lending institution. Daily interest accruals result in debits to this account. Whenever an interest payment is made, the amount of the interest payment is credited to this account. |

| Accrued Interest 2 | An alternate interest receivable asset account for use with user-defined transaction codes. |

| Accrued Def Int 1 | An interest receivable asset account for deferred interest. |

| Accrued Def Int 2 | An alternate interest receivable asset account for deferred interest. |

| Accrued Late Fees 1 | This is an asset account (receivable). It tracks the amount of late fees owed by the borrowers to the lending institution. The assessment of a late fee results in a debit to this account. Payment of a late fee results in a credit to this account. |

| Accrued Late Fees 2 | An alternate late fee receivable asset account for use with user-defined transaction codes. |

| Accrued Fees 1 | This is an asset account (receivable). It tracks the amount of any fees (other than late fees) that are owed by the borrowers to the lending institution. Any transaction that causes a fee to be assessed will result in a debit to this account. The payment of any such fee will result in a credit to this account. |

| Accrued Fees 2 | An alternate fee receivable asset account for use with user-defined transaction codes. |

| Interest Income 1 | This is a revenue account. Daily interest accruals are credited to this account. |

| Interest Income 2 | An alternate interest revenue account for use with user-defined transaction codes. |

| Deferred Int Income 1 | An interest revenue account for deferred interest. |

| Deferred Int Income 2 | An alternate interest revenue account for deferred interest. |

| Late Fees Income 1 | This is a revenue account. Any late fee assessed will result in a credit to this account. |

| Late Fees Income 2 | An alternate late fee revenue account for use with user-defined transaction codes. |

| Fees Income 1 | This is a revenue account. A fee (other than late fees) assessment will result in a credit to this account. |

| Fees Income 2 | An alternate fee revenue account for use with user-defined transaction codes. |

| Accounts Payable 1 | This is a liability account. An impound distribution results in a credit to this account. |

| Accounts Payable 2 | An alternate payable account for use with user-defined transaction codes. |

| Impound 1 | This is a liability account. The account is credited when a borrower pays money to impound and debited when the impound is distributed. |

| Impound 2 | An alternate Impound account for use with user-defined transaction codes. |

| Writeoff, Principal | This is an expense account. A principal write-off transaction results in a debit to this account. |

| Writeoff, Interest | This is an expense account. An interest write-off transaction results in a debit to this account. |

| Writeoff, Late Fees | This is an expense account. A late fee write-off transaction results in a debit to this account (generally, late fees should be reversed rather than written off, unless the write-off is a result of a Payoff Transaction). |

| Writeoff, Other Fees | This is an expense account. Any transaction that writes off a fee that is not a late fee, will result in a debit to this account. |

| Suspense | This is a liability account. Any overpayments that result from payoff transactions will result in a credit to this account. This account is usually cleared out periodically by issuing refunds, or by transferring the funds to some revenue account if the funds are to be kept by the lending institution. |

| Global Suspense | Transactions made “From Global Suspense” will result in a debit to this account. |

| Used when a transaction in the Global Suspense List is right-clicked and expired is selected. The Global Suspense money is moved from the GL of the Global Suspense into the GL of the Expired Global Suspense. The GL Date for the “expiry” of the Global Suspense is the date when the Expired button is clicked. | |

| User Def #1 – #50 | These accounts are used only for user-defined transactions. The transaction will credit or debit accounts according to the Manual Transaction Code Setup. |

| Non Accrual Interest | This account is used for GL NON ACCRUAL status code. |

| Non Accrual Interest Income | This account is used for GL NON ACCRUAL status code. |

| Non Accrual Def Interest | This account is used for GL NON ACCRUAL status code. |

| Non Accrual Def Interest Income | This account is used for GL NON ACCRUAL status code. |

| Non Accrual Late Fee | This account is used for GL NON ACCRUAL status code. |

| Non Accrual Late Fee Income | This account is used for GL NON ACCRUAL status code. |

| Non Accrual Fee | This account is used for GL NON ACCRUAL status code. |

| Non Accrual Fee Income | This account is used for GL NON ACCRUAL status code. |

| Charge-Off Loan Loss | This account is used for GL CHARGE OFF status code. |

| Charge-Off Loan Loss Recovery | This account is used for GL CHARGE OFF status code. |

| Charge-Off Principal | This account is used for GL CHARGE OFF status code. |

| Charge-Off Interest | This account is used for GL CHARGE OFF status code. |

| Charge-Off Def Interest | This account is used for GL CHARGE OFF status code. |

| Charge-Off Late Fee | This account is used for GL CHARGE OFF status code. |

| Charge-Off Other Fee | This account is used for GL CHARGE OFF status code. |

| Charge-Off UDB1-10 | These accounts are used for GL CHARGE OFF status code. |

| Transfer Principal | This account is used when transferring a loan from one loan group to another. |

| Transfer Interest | This account is used when transferring a loan from one loan group to another. |

| Transfer Deferred Interest | This account is used when transferring a loan from one loan group to another. |

| Transfer Late Fee | This account is used when transferring a loan from one loan group to another. |

| Transfer Other Fee | This account is used when transferring a loan from one loan group to another. |

| Transfer UDB1-10 | These accounts are used when transferring a loan from one loan group to another. |

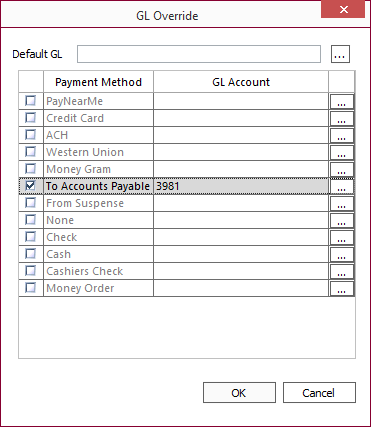

Payment Method Override

The GL account number attached to any placeholder may be overridden based on the Payment Method. An example where this might be used would be that the cash account to be debited when a payment comes in, might be different if the payment comes in through a check or through an ACH.

To set up a payment method override, click the Override button corresponding to the appropriate placeholder. This will bring up the GL override window.

The Default GL is used for any payment methods that are not overridden. To override a payment method, select the payment method and add the general ledger account to use in the “GL Account” field. When a transaction is entered into NLS, if the transaction is mapped to this placeholder, and an overridden payment method is used, then the appropriate overridden general ledger account will receive the GL credit or debit.

Flip Dr/Cr on Transactions

When selected, this option will flip the debits and credits for any transaction executed on a loan that belongs to this loan group. This option is useful if the loans are shown as liability type loans on the general ledger instead of the standard asset type loan.

Non-Accrual Unwind All Accrued Interest

NLS 5.9 and later

When selected, a loan in this group that enters a non-accrual state will unwind all accrued interests on the loan from the interest income account.

When entering non-accrual:

| Debit | Credit |

|---|---|

| Interest Income | Non Accrual Interest Income |

| Non Accrual Accrued Interest | Accrued Interest |

When a payment is applied:

| Debit | Credit |

|---|---|

| Cash | Non Accrual Accrued Interest |

When exiting non-accrual:

| Debit | Credit |

|---|---|

| Non Accrual Interest Income | Interest Income |

| Accrued Interest | Non Accrual Accrued Interest |

Charge Off Affect Principal Only (Trans Code 490)

NLS 5.11 to 5.14

When selected, charge offs using the transaction code 490 will only affect the principal balance of the loan and not the total loan balance. This may be used to exclude the charge off from credit bureau reports.

Total Charge Off Balance (Trans Code 490) Includes

NLS 5.15 and later

Select whether to include All Balances, Principal Only, or Principal + Interest Only in the total charge off balance when charge offs are made using transaction code 490.

GL Segments Tab

NLS 5.6 and later

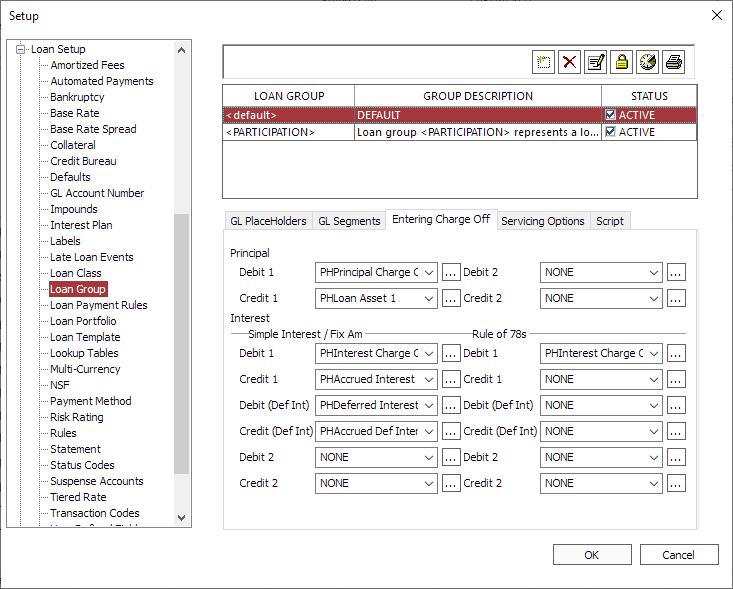

The values to be used in segmented GL numbers can be entered here. The corresponding {G1} and {G2} placeholders in GL numbers will be replaced.Entering Charge Off Tab

NLS 5.28 and later

General ledger controls for the principal and interest of loans entering charge-off may be configured in the Entering Charge Off tab.

Note

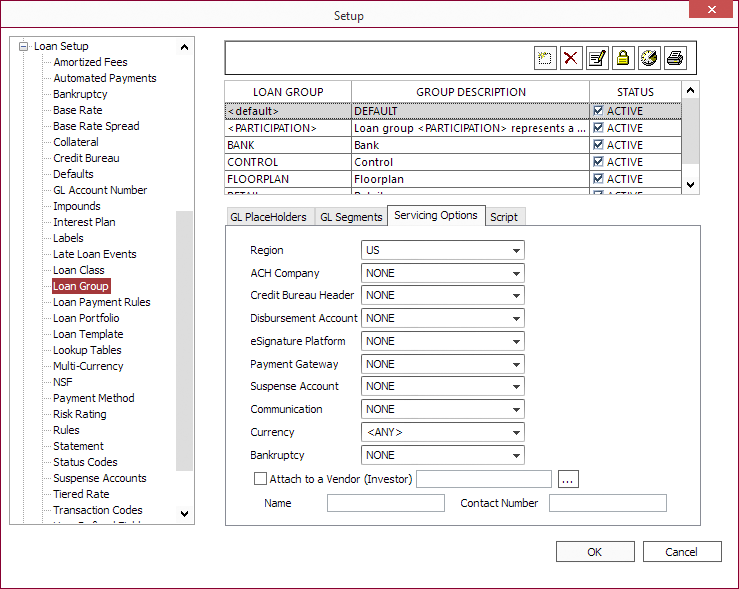

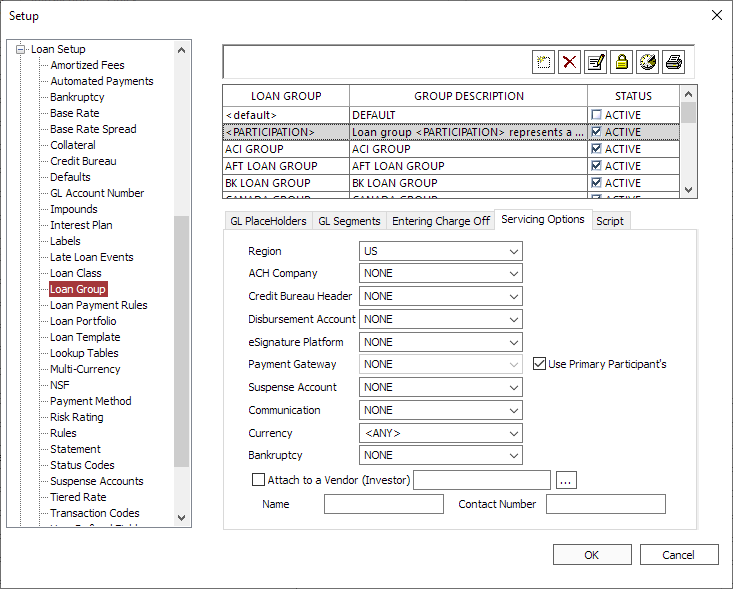

Rule of 78 Debit (Def Int) and Credit (Def Int) are not implemented.Servicing Options Tab

The Servicing Options tab is used to control servicing of loans for other lenders. A loan group can be configured to represent the loans that you are servicing for another lender. On the servicing options tab of that loan group, you can link the group to ACH/AFT codes, credit bureau codes, disbursement accounts, and vendor accounts that are configured for that lender.

Also, in order to enable payment card processing for the loans in this loan group, you must select a payment gateway. See the section on Payment Gateway on configuring a payment gateway.

A suspense account may be selected to control the flow of funds in the event that a payment is received for which it is not known to which loan it should be posted.

Communication setup may be selected to use the email and SMS servers and templates that has been configured.

NLS 5.2.0 and later

When multiple currencies are configured, the loan group can be configured so that only the specified currency can belong to the loan group. Choose <ANY> in the Currency dropdown list to allow all currency types to be in the loan group.NLS 5.7 and later

Region setting will determine whether to use ACH/AFT or generate a Metro 2 file. This option is available only when Setup > Loan Setup > Defaults > ACH > Format is set to Both.NLS 5.15 and later

eSignature Platform may be selected to use DocuSign for managing electronic documents.NLS 5.19 and later

Bankruptcy may be selected to use a bankruptcy setup to manage bankruptcies.NLS 5.31 and later

When Use Primary Participant’s option next to Payment Gateway is selected, the primary participant’s payment gateway will be used. This option is only available for the <PARTICIPATION> loan group.

NLS 5.38 and later

Select Use participant’s investor on a participated loan option to bill the servicing fee to a participant’s vendor instead of the vendor configured for the loan group.Script

Scripts are used during loan group transfers. See the Securitization section for details on batch loan group transfers.

to see a list of the setup parameters after the modification was made.

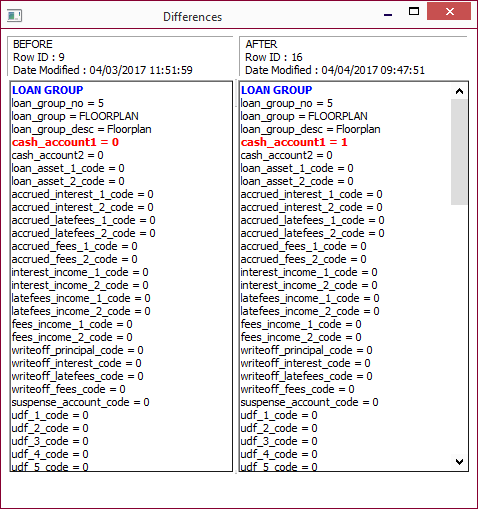

to see a list of the setup parameters after the modification was made. to see a side-by-side list of the setup parameters before and after the modification. This is useful to illustrate the specific change.

to see a side-by-side list of the setup parameters before and after the modification. This is useful to illustrate the specific change.